missouri gas tax bill 2021

In 2002 2014 and 2018 Missouri voters opposed ballot measures that would have increased funding to help. Even with the new tax increase the buying power of the fuel tax wont equal what it was in 1996.

/cloudfront-us-east-1.images.arcpublishing.com/gray/VJPP4KNLC5ES3BVHKNTZDVHUCU.jpg)

Gas Pump Relief Missouri Bill Proposes Lifting State Fuel Tax For 6 Months

Prior to October 1 2021 the motor fuel tax rate was 017 per gallon.

. Patrick McKenna director of the Missouri Department of Transportation speaks at the I-70 Bridge groundbreaking ceremony on Oct. Current Bill Summary. Submitted by Brent Hugh on Wed 05122021 - 500am.

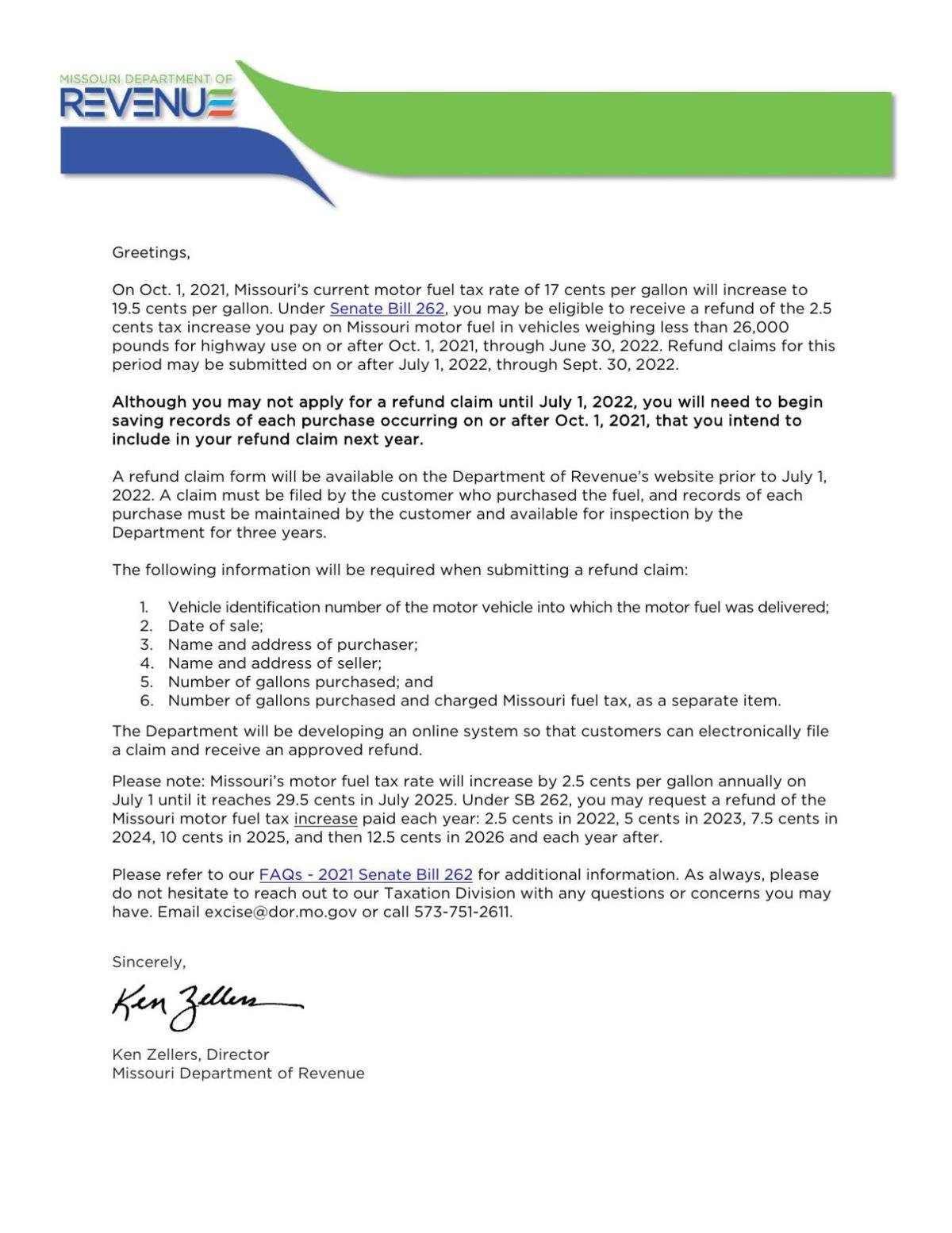

The increases were approved in Senate Bill 262. Around that time the Missouri DOR announced Missourians might be eligible for refunds of the 25 cents tax increase per gallon paid on gas purchases after Oct. 1012021 6302022 Motor Fuel Tax Rate increases to 0195.

Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the first increase beginning on October 1 2021 and increases each year as follows. According to Missouri DOR. Today the Missouri Legislature passed a 125 per gallon fuel tax increased to be phased in at the rate of 25 cents per year from 2021 to 2025.

Fuel purchases in Missouri decreased 6 in 2020 and rebounded to 2019 levels in 2021. The tax will increase an additional 25 cents per gallon in each fiscal year until reaching an additional 125 cents per gallon on July 1 2025. Facing an 825 million annual priority project backlog it was the first time since 1992 that Missouri increased its gas tax.

Under Ruths plan the gas tax would rise by two cents per gallon on Jan. It increases the state gas tax by 125 cents per gallon over five years from 17 cents per gallon to 295 cents per gallon by 2026. At the end of 2025 the states tax rate will sit at 295 cents per.

Restaurants In Erie County Lawsuit. Missouri gas tax increase 2021. Missouri Legislature passes 125 cent gas tax increase phased in over four years - headed to Gov for signature and its done.

Missouris current tax is 17 cents per gallon on all motor fuels including gasoline diesel and. The bill also includes a 20 percent increase on the cost of an alternative fuel decal purchased each time a vehicles. 12 2021 in Rocheport photo courtesy of Missouri Governors Office.

Opry Mills Breakfast Restaurants. Becky Ruth chair of the House Transportation Committee. The proposal SB 262 would increase Missouris fuel tax by 25 cents annually bumping it up to 295 cents.

712022 6302023 Motor Fuel Tax Rate increases to 022. JEFFERSON CITY Mo. The first 25-cent increase is slated to take effect in October which will bring the gas tax to 195 cents.

Are Dental Implants Tax Deductible In Ireland. Schatzs senate bill 262 would increase missouris gas tax by 125 cents per gallon by 2025. By herald staff november 13th 2021.

1 2022 and will then increase by an additional two. JEFFERSON CITY Mo. 1012021 6302022 Motor Fuel Tax Rate increases to 0195.

The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. Alaska is the only state with a lower gas tax with an eight-cent-per-gallon rate. MODOT Director Patrick McKenna said money will go towards as many of the states more than 400 unfunded projects as possible.

After more than four hours on the floor the Missouri House truly agreed to and finally passed a proposed gas tax increase late Tuesday a victory for Senate President Pro Tem Dave Schatz. 1 until the tax hits 295 cents per gallon in july 2025. The first of five annual gas tax increases of 25 cents per gallon takes effect reaching a total increase of 125 cents by 2025.

1 until the tax hits 295 cents per gallon in july 2025. Missouri bill would boost gas tax but offer rebates to drivers February 9 2021 By Alisa Nelson A proposed fuel tax increase could come with a. 1 until the tax hits 295 cents per gallon in July 2025.

Luckily for MoDOT the pandemic didnt lead to a long-lasting drop and its prediction in 2014 of ever-declining fuel purchases has not come to pass. Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep. The tax would go up 25 cents a year starting in October 2021 until the increase.

With 65 billion on the way. But that doesnt mean the state is ready to tackle its biggest projects like rebuilding and. Beginning in October 2021 when the new law kicks in an additional 25 cents per gallon tax on motor fuel in Missouri will be collected.

Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the first increase beginning on October 1 2021 and increases each year as follows. Restaurants In Matthews Nc That Deliver. The tax is set to increase by the same amount yearly between 2021 and 2025.

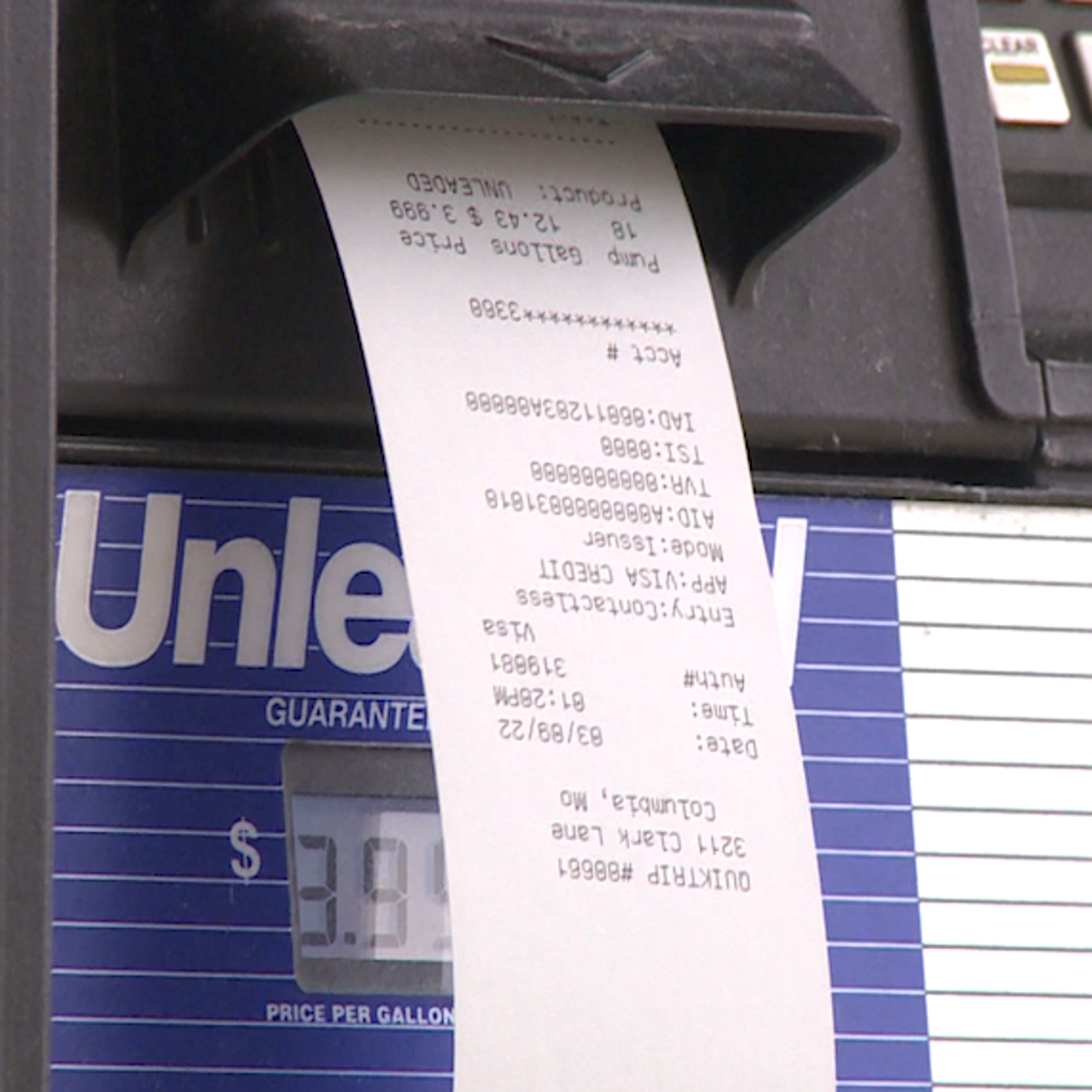

The 1996 legislation prevents the general assembly from. The legislation includes a rebate process where drivers could get a refund if they save their gas receipts and submit them to the state. The law will gradually raise the states 17-cent-a-gallon gas tax to 295 cents over five years with the option for buyers to get a refund if they keep track of their receipts.

The proposal SB 262 would increase Missouris fuel tax by 25 cents annually bumping it up to 295 cents from 17 cents by. SS2SCSSB 262 - This act modifies provisions relating to transportation. The bill would raise Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct.

When fully implemented on July 1 2025 the gas tax would be 299 cents a gallon and would add 3375 million annually to the state road fund and 125 million for city and county governments to spend on local roads. The money will be used for Missouris roads and bridges. MOTOR FUEL TAX Sections 142803 142822 and 142824 This act enacts an additional tax on motor fuel beginning with 25 cents in October 2021 and increasing by 25 cents in each fiscal year until reaching an additional 125 cents per gallon on July 1 2025.

Mike parson later signed into law sb262 to increase the states fuel tax for the first time in nearly 30 years. Missouri Gas Tax Bill 2021. The state will incrementally increase the gas tax by 25 cents annually with the funds earmarked for road and bridge repairs.

Mike Parsons R signed Senate Bill 262 SB 262 into law on July 13 2021.

Last Day Of 2021 Session Gas Tax Online Taxes Forms Of Birth Control

Gas Tax Cut Again In Missouri Nextstl

Gas Tax Cut Again In Missouri Nextstl

Gas Tax Cut Again In Missouri Nextstl

Gas Tax Cut Again In Missouri Nextstl

App Can Help Missourians Easily Keep Track Of Gas Receipts State News Komu Com

Illinois Doubled Gas Tax Grows A Little More July 1

Missouri Fuel Tax Increase Goes Into Effect On October 1

Missouri Department Of Revenue Plans To Offer Money Back On Gas Purchases Koam

Gas Tax Cut Again In Missouri Nextstl

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com